4 Different Asset Classes To Help You Grow Your Wealth

Posted by Anushiem Chidera on August 24, 2022 in Guide

4 Different Asset Classes To Help You Grow Your Wealth

One of the age-long principles of personal finance is that growing your wealth is done by living on what you earn, saving the rest, and investing in profitable assets. For many, the first two requirements are easy. The third, however, is where many fall short. For some, this is a result of inadequate knowledge of the subject matter; for others, they do not know which assets to invest in.

If you belong to either group, this article will teach you about the asset classes to invest in. It will also teach you which assets will bring the most (or least) returns on investment.

Why Should You Learn About Asset Classes?

To invest successfully, you need to understand what you are investing in and why you are investing in it. Understanding the peculiarity of the asset type you are investing in helps do quality research to make sound investment choices.

Good research of these asset classes will help you determine what percentage of your capital goes into what and why. So if you are confused about whether to invest your money in a fixed deposit or a mutual fund, or whether to invest in gold ETFs or PPFs, just ask – “Which asset class does it belong to?”

What Are Asset Classes?

Asset classes can be seen as a big basket where all the financial assets belonging to that asset class share common characteristics. For every asset class, things like returns, risk, liquidity, and various other parameters are similar.

For example, Fixed Deposits and PPFs are different financial instruments, but at a deeper level, they both are secure products, as you do not lose money when you invest in these products. Also, their returns are predefined and there is some level of stability or predictability in their returns—they are what you call ‘low risk, low returns’ assets. Because of these similarities that they share, they belong to an asset class known as “Fixed Income”.

Here is a video that gives an introduction to asset classes

By the same token, equity mutual funds and direct stocks are different financial instruments when examined in-depth. However, when you zoom in, you see that they both are high volatility instruments and have the potential to multiply your investment many times within a short period of time. This is characteristic of all assets in the asset class called “Equities.”

While there is no standard list or category of asset classes, it is widely accepted that there are 5 major types of asset classes. These asset classes are:

- Fixed Income

- Cash

- Equity

- Real Estate

- Commodities

Every financial asset you come across will fall into any of these 5 asset classes only. Each asset class has its own patterns of behavior, and they represent something unique about them. The chart below shows you financial products belonging to these asset classes and what these asset classes represent:

We will however not discuss cash as an asset class in this article for obvious reasons.

1. Fixed income

Let’s start with the most popular asset class, which is “Fixed Income”. Fixed Income asset class refers to the class of financial products where your investment amount is more or less protected and the returns are either fixed or predictable to a very large extent. There is very little to no risk when you invest in these products. Likewise, the returns are not anything above the ordinary.

Investing in a fixed income asset is like lending your money to someone with the assurance of the debtor paying back with a predefined interest. So when you make a fixed deposit in a bank, you are not exactly “investing”, but lending your money to the bank with a promise that they will pay back your principal, along with a predefined interest.

Fixed Deposits do not beat inflation

Even if you are getting an 8-9% return on your fixed deposits, you should realize that it is the pre-tax return. As Fixed deposits are taxable (as with every other debt instrument), once you pay the tax on the returns, the post-tax returns are only in the range of 6-7% and if you adjust for Nigeria’s astronomical inflation of 20%, you may be getting a negative return on your fixed-income investments.

Lower Risks, Lower Returns

If you want a fixed return and do not want to take any risk, you should choose this asset class. It's human nature to seek certainty in a world dominated by risk, and given that fact, fixed income instruments are a big deal amongst investors. Fixed Deposits rule the world of investments as it is less risky. It is also simple and easy to understand.

The same goes for PPF, NSC, recurring Deposits, and various Nigerian-government-issued bonds, treasury bills, and other debt mutual funds.

PS: A downside to this asset class is the assets do not hedge against inflation, hence over the long term, while the amount of your investment will become bigger in number, the purchasing power will remain stagnant or might drop. So this asset class serves only to only protect your money, not to grow it.

Get started with fixed-income assets by reading this guide.

2. Equities

The equity asset class is an interesting asset class that has slowly gained more and more acceptance within the last 1 to 2 decades.

Equity means ownership

When you invest in equities, it means that you have bought some portion of the ownership of a business. For example, when you buy stocks of UBA or MTN, you become a small owner of those businesses commensurate with the proportion of the business that you bought.

Now, when you invest in the business, you get a % ownership. And if that company becomes bigger someday in the future (or big, depending on if you invested in an early-stage startup), the overall worth of your investment also goes up. But there is a catch: the business grows only over time and in between, there are ups and downs and that reflects in the stock price of the business/company. Within these downs, your investment will decrease proportionally.

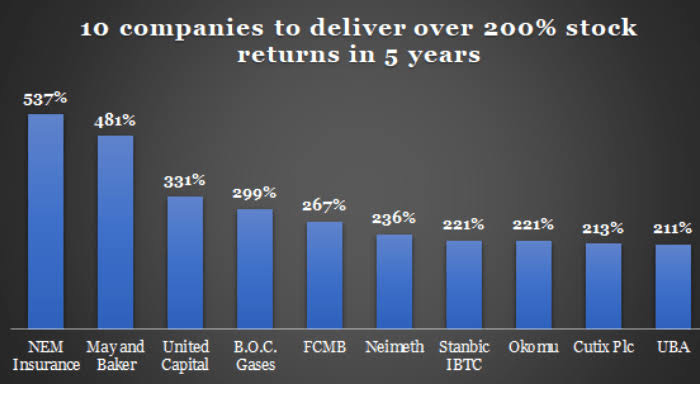

Equity Investing works in the long run Below is the 10-year-return chart for 10 Nigerian companies. It is evident that all ten of these companies gave back over 200% returns (much more than that in some cases) in the last decade.

Because the returns from equities are very volatile, most people refrain from mutual funds investment or investing in direct stocks, but they are the real wealth builders for any investor. There are mutual funds from various Asset management companies that have a proven track record for building wealth for their investors. You can check out which Nigerian stocks you should buy here, how to buy into companies by buying their shares here, and how to pick which stocks to buy here.

3. Real Estate

Over the last 2 decades, real estate has gotten tremendous interest from investors. Since the housing bubble of the early 2000s — which ultimately triggered the 2008 financial crisis — there has been an unstoppable spike in real estate investments. Everyone now wants to own a home and real estate has become a very sought-after asset class as a result. As the country develops and expands, we see many upcoming areas being developed in all cities. Places that were hitherto considered ‘outskirts’ are now being developed and converted into cities, and investors are seeing amazing returns on their real estate holdings.

PS: like every investment, there is a risk associated with real estate investment. With real estate, unsuspecting investors could fall victim to scammers and false agents who simply want to rip people off their money. Ensure to only invest with trustworthy agents/ real estate firms.

Returns from Real Estate

The real estate market has cycles of ups and downs and returns from real estate often depend on various factors like town planning, govt policies, political situations, and many more. With good (or bad) government policies, you could see your investment go down the drain. Examples of such situations are in cases of demolishing of buildings, revoking of Certificate of Occupancy, and more.

Unfortunately, there are only three registered Real Estate Investment Trusts (REITs) in Nigeria. Thus, with real estate, you need a high ticket size for investment, and the market is barely regulated (if at all) and it’s more or less a one-sided market with a lot of opaqueness.

This video details a zero-to-hero real estate investment journey from a Nigerian perspective:

https://m.youtube.com/watch?v=U6bS8DML3PU

4. Commodities

Commodities refer to various types of physical goods or valuable products or metals which you can buy and sell for various uses. Gold, Silver, Copper, Rice, Oil, etc are counted under this asset class. The price of these products depends on the forces of market demand and supply.

P.S: Commodities are not for investing for the long term, but mainly for trading, where you can benefit from the market cycles and predict demand and supply moves and get a profit or loss.

Returns from the commodities can be very volatile and each commodity has its own market and dynamics. From forex to metals, special skills in analyzing and understanding the markets are important to thrive. Only a handful of commodities like Gold or Silver can be invested in for a very long time because they can be stored without losing their value or use cases. You can’t store other commodities in the same way, hence trading them in the short term is a feasible option.

Which asset class should you invest in?

Which assets should you invest your money in? This question can only be answered if you are clear about your requirements, such as your appetite for risk and your expected return on investment.

Are you fine with locking your money for several years or not? If not, you may want to consider which asset class suits your patience levels. The table below compares all asset classes on various parameters.

Whichever asset class you choose to invest in, the most important thing is that you invest. Because that is your sure way to building wealth.